In 2017 Gartner reported that optical transceivers accounted for approximately 10-15% of the enterprise network capital spending. During this time, you have likely purchased your optical transceivers from the same networking vendor from which you procured your routers or switches. However, the weight of the optical transceiver component has been growing, especially with the broad availability of 100G and 400G optics, which resulted in additional cost pressures. This led to the growing trend of organizations seeking more cost-effective alternatives by leveraging third-party-provided optics, opening up a broader market of options and better prices.

According to FS, the global third-party transceiver market is predicted to grow to $1.34B by 2027 from $620M in 2017. That is faster than the estimated growth for the network equipment market, which means this trend is consolidating. However, one new consequence is that additional operational challenges arise associated with the ability to properly manage, track and monitor the deployed base of third-party optical transceivers.

While trying to address a Capex issue, we may have triggered a new Opex issue. Fortunately, new technology is here to help, and data and algorithms can alleviate new operational challenges. Selector Analytics now supports a new module focused on the pain points associated with optical transceivers, especially in the context of third-party vendor transceivers.

Now, we can help answer various questions, such as:

- Is there any transceiver out of compliance based on its vendor recommendations?

- Is there any transceiver behaving anomalously, which may indicate a future failure?

- What is the state of the deployed transceiver inventory?

- What is the percentage of each transceiver vendor and/or type in your deployed base?

- How is the transceiver inventory evolving in your network?

- What are the pockets of lower quality in your optical transceiver deployed base?

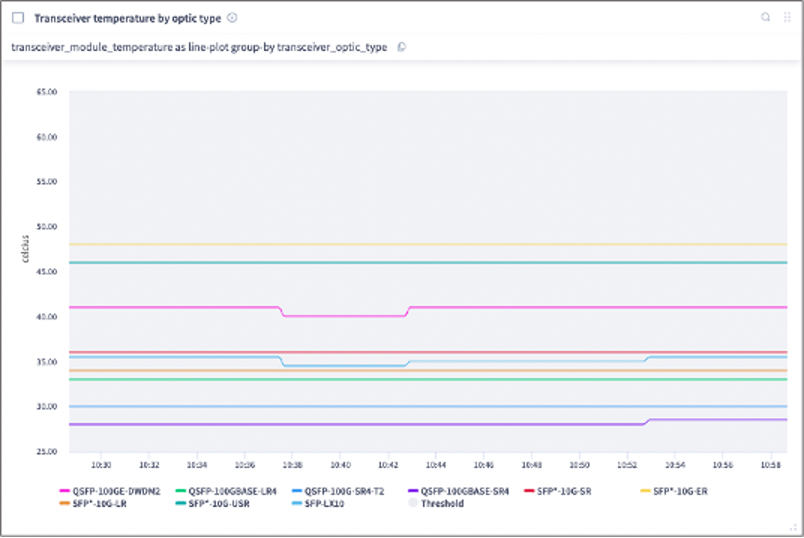

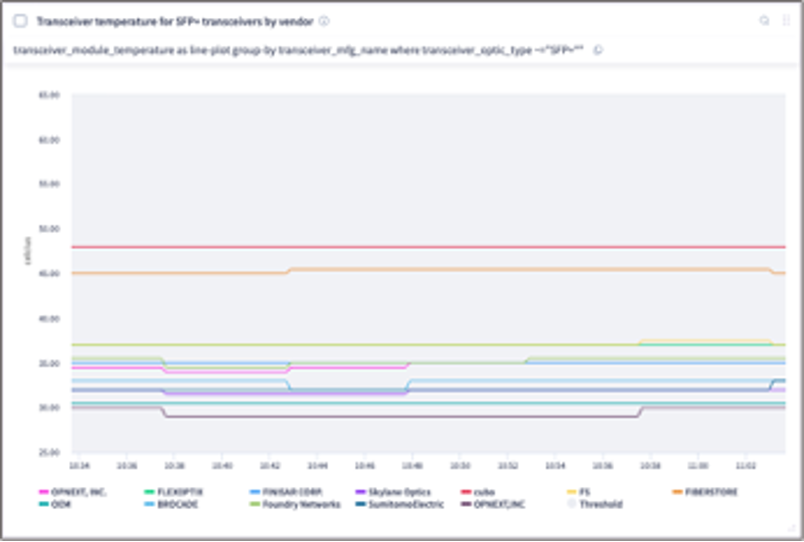

Selector Analytics collects Digital Optic Metrics (DOM) from optical transceivers to answer these questions and others. Furthermore, we collect additional information to correlate the metrics, including optical transceiver vendor, optic type, part number, device vendor, location, etc. This helps contextualize the data collected and enables algorithms to detect anomalies and misbehaviors that may be leading indicators for failures.

With these capabilities, multiple stakeholders in the network organization can improve their decisions and processes more efficiently. Network technology engineers can observe the quality of specific models, vendors, or combinations and make better technology and vendor decisions for the deployment teams. Network Operation teams can proactively identify likely areas of failure and minimize truck rolls by coordinating faulty or possible faulty transceivers replacement before they have a service impact by leveraging other maintenance operations that require in-situ personnel. Network planners and procurement teams can now have an up-to-date view of their deployed base of transceivers and their quality performance KPIs. This allows them to discuss with their vendor plans for improvement or better conditions in a context where optical transceivers have significantly contributed to the network costs and therefore require adequate management.

By applying different techniques, including ML-based time-based anomaly detection, outlier detection, and time series forecasting, the Optical Transceiver Analytics module sheds light on a previously highly obscure field of optical transceivers. Multiple dimensions of analysis are now possible by transceiver vendor, location, optical type, device vendor, etc., which may reveal surface anomalies that otherwise might not be visible.

The Optical Transceiver Analytics module will help your network team:

- Minimizing truck rolls and enabling coordinated and proactive maintenance of your installed base.

- Improving network MTBF by reducing the footprint of transceivers that have lower quality and preventing failures.

- Facilitating better negotiations with transceiver vendors based on data.

- Proactively identifying pockets of quality degradation.

Below are several screenshots that illustrate this feature:

Interested in learning more about Selector Analytics? Contact us for more information.